Grasping Extra security in Australia: A Thorough Aide? Life coverage is a significant monetary item that gives genuine serenity to people and their families. In Australia, there are a few sorts of extra security strategies accessible, including term life coverage, entire life coverage, and pay assurance protection. When selecting the appropriate life insurance coverage for your requirements, it is essential to comprehend the distinctions between these policies.

Term life coverage is the most widely recognized kind of extra security strategy in Australia. It gives a singular amount installment to your recipients on the off chance that you die during the term of the strategy. The policyholder has the option of choosing the length of the policy, which can be anywhere from one year to up to 30 years. Entire disaster protection arrangements, then again, give inclusion to the whole existence of the policyholder. They are a more costly choice, yet they likewise give a money esteem part that forms after some time.

This money worth can be utilized to acquire against or even money out if necessary. Another important kind of life insurance policy in Australia is income protection insurance. It turns out a customary revenue to policyholders in the event that they can’t work because of injury or disease. This sort of arrangement can be especially significant for the people who are independently employed or depend on their pay to help their loved ones. While picking a life coverage strategy in Australia, taking into account your singular requirements and circumstances is significant. Factors like age, wellbeing, and monetary objectives ought to be generally considered while choosing a strategy. Looking for proficient counsel from a certified monetary organizer can likewise be useful in going with the ideal choice for yourself as well as your loved ones.

Exploring the Benefits of Life Insurance: Why It’s Important for Australians to Have It Life insurance is an important investment for Australians because it gives you and your loved ones financial security and peace of mind. In the event of your death, it may assist your family in managing unexpected costs, such as funeral costs, outstanding debts, and ongoing living expenses. Life insurance can also help pay for your children’s education and cover the loss of income. By putting resources into disaster protection, you can guarantee that your family is dealt with in case of a misfortune. Moreover, a few strategies can offer living advantages, like covering clinical costs or turning out revenue on the off chance that you become incapacitated. By and large, life coverage is a significant thought for any Australian hoping to safeguard their friends and family and secure their monetary future.

The Various Sorts of Life coverage Approaches Accessible in Australia: Disaster protection strategies are a fundamental piece of monetary preparation, and there are various kinds of life coverage arrangements accessible in Australia to take care of the assorted necessities of people. These approaches are intended to offer monetary help to the family in the event of an unfavorable passing of the policyholder. Term disaster protection, otherwise called passing cover, is one of the most famous kinds of life coverage approaches. It gives a singular amount installment to the recipients on the off chance that the policyholder dies during the strategy term. One more sort of life coverage strategy is pay security protection, which turns out a customary revenue to the policyholder on the off chance that they can’t work because of disease or injury. Aggregate and extremely durable handicap (TPD) insurance is one more sort of disaster protection contract that pays a singular amount assuming that the policyholder can’t work because of a long-lasting inability. Injury protection, otherwise called basic sickness protection, gives a singular amount installment on the off chance that the policyholder is determined to have a basic disease, for example, malignant growth, coronary episode, or stroke. The decision of disaster protection strategy relies upon individual necessities, monetary objectives, and way of life. It is prescribed to look for proficient guidance prior to picking a disaster protection strategy to guarantee it meets your particular prerequisites.

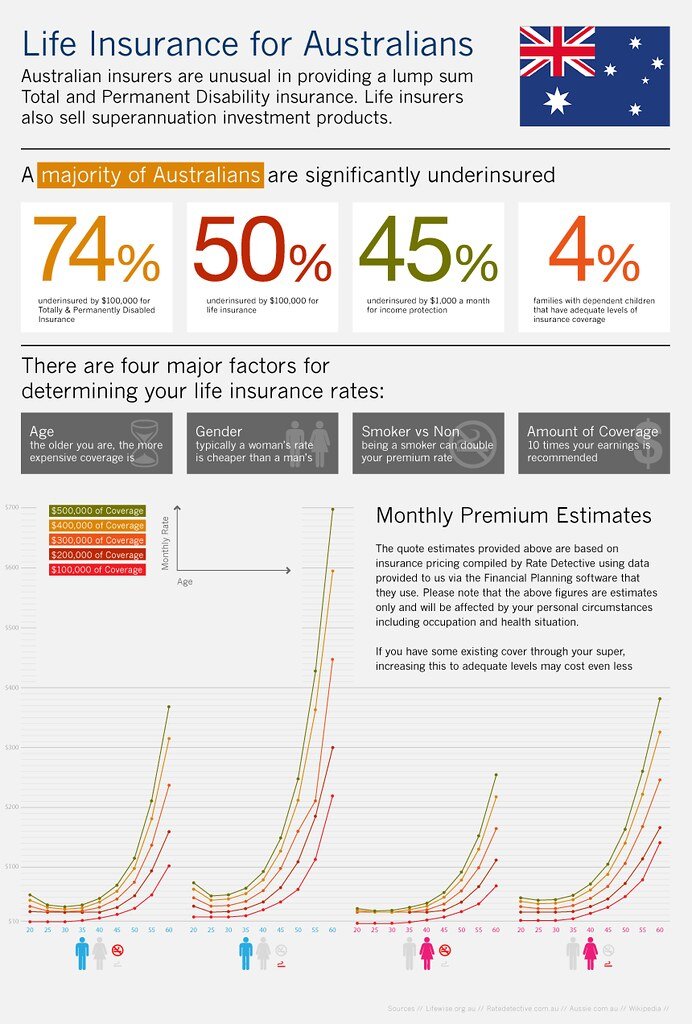

Instructions to Pick the Right Disaster protection Strategy for Your Requirements : Picking the right extra security strategy can be overpowering, however it’s an essential choice. Think about your monetary objectives, wards, and spending plan to decide your inclusion needs. Analyze strategy types, expenses, and riders to track down one that meets your prerequisites. Make sure to direction from a monetary counselor or protection specialist. The Expense of Life coverage in Australia: What You Really want to Be aware : Life coverage is a significant speculation, however the expense can fluctuate contingent upon variables like age, wellbeing, and way of life. In Australia, charges can go from a couple of dollars to many dollars each month. It’s essential to comprehend what influences the expense of life coverage to go with an educated choice that suits your necessities and spending plan.

What Variables Influence the Expense of Extra security in Australia? The expense of disaster protection in Australia is impacted by different variables. The age of the candidate, first and foremost, assumes a huge part in deciding the expense of charges. As the candidate ages, the gamble of death increments, thus does the expense of protection. Furthermore, how much inclusion required additionally influences the expense of disaster protection. Premiums are based on the level of coverage. Different variables that can affect the expense of extra security incorporate the candidate’s wellbeing, occupation, way of life propensities, and family clinical history. The cost of premiums can also be affected by the type of policy chosen, such as whole or term life insurance.

Ways to analyze Life coverage Strategies in Australia : While contrasting disaster protection approaches in Australia, it’s vital to consider factors, for example, the sort of arrangement, inclusion sums, charges, holding up periods, avoidances, and advantages. In addition, it’s a good idea to read the fine print, compare quotes from a number of insurers.

The Job of Life coverage in Home Anticipating Australians: Disaster protection can assume a significant part in bequest anticipating Australians. In the event of your untimely death, it ensures your loved ones’ financial security. Basically, disaster protection is an agreement among you and a protection supplier that ensures a payout to your recipients upon your passing. This payout can be utilized to cover costs, for example, memorial service costs, remarkable obligations, and even to give a legacy to your friends and family. As far as domain arranging, disaster protection can assist with guaranteeing that your recipients are dealt with monetarily and that your home can be circulated according to your desires. It’s critical to consider your protection needs and choices cautiously and to talk with a monetary guide or domain organizer to guarantee that your home arrangement is customized to your particular conditions.

Disaster protection for Entrepreneurs in Australia: What You Want to Be aware: As an entrepreneur in Australia, life coverage is a significant thought to get the fate of your business and your friends and family. In the event of a sudden death or serious illness, it may offer financial protection. Understanding the various sorts of cover accessible and their advantages prior to settling on a choice is significant.

Normal Misinterpretations About Life coverage in Australia Exposed: There are a few confusions about extra security in Australia that can keep individuals from going with informed choices. It is frequently interpreted as a waste of money or as only beneficial to older people. Notwithstanding, these legends are exposed as life coverage can give monetary security to people and their families at whatever stage in life.

nice

good

আমি এখানে কাজ করতে চাই কোনরকম জামেলা ছাড়াকাজ করতে চান

Modern Talking был немецким дуэтом, сформированным в 1984 году. Он стал одним из самых ярких представителей евродиско и популярен благодаря своему неповторимому звучанию. Лучшие песни включают “You’re My Heart, You’re My Soul”, “Brother Louie”, “Cheri, Cheri Lady” и “Geronimo’s Cadillac”. Их музыка оставила неизгладимый след в истории поп-музыки, захватывая слушателей своими заразительными мелодиями и запоминающимися текстами. Modern Talking продолжает быть популярным и в наши дни, оставаясь одним из символов эпохи диско. Музыка 2024 года слушать онлайн и скачать бесплатно mp3.

9ofx25

batmanapollo.ru

site

Outstanding feature

Hi, i think that i saw you visited my blog so i came to “return the favor”.I am trying to find things to improve my website!I suppose its ok to use a few of your ideas!!

I am delighted that I discovered this weblog, precisely the right info that I was searching for! .